RED VIOLET ANNOUNCES FIRST QUARTER 2019 FINANCIAL RESULTS

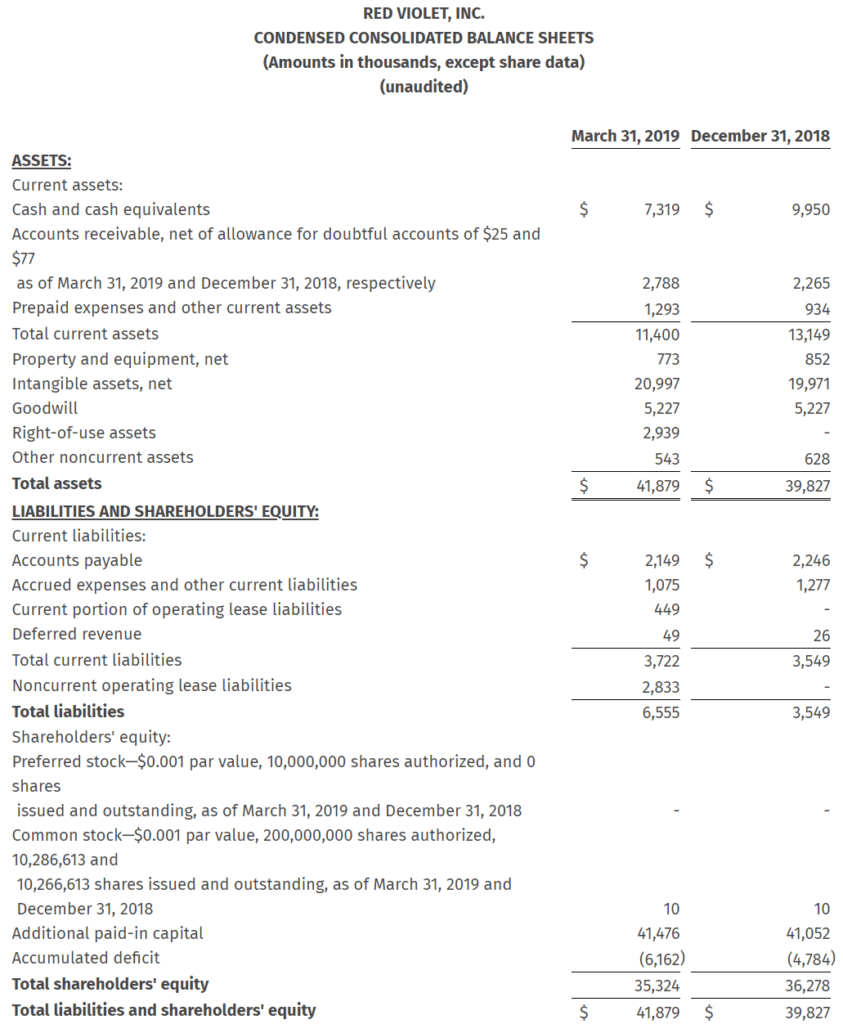

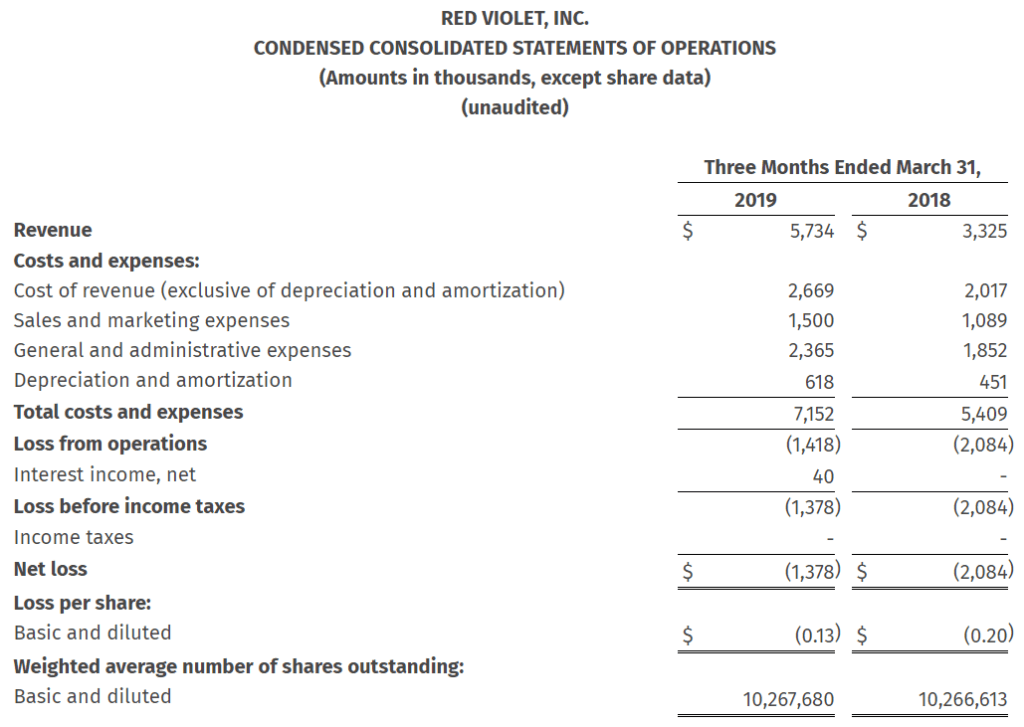

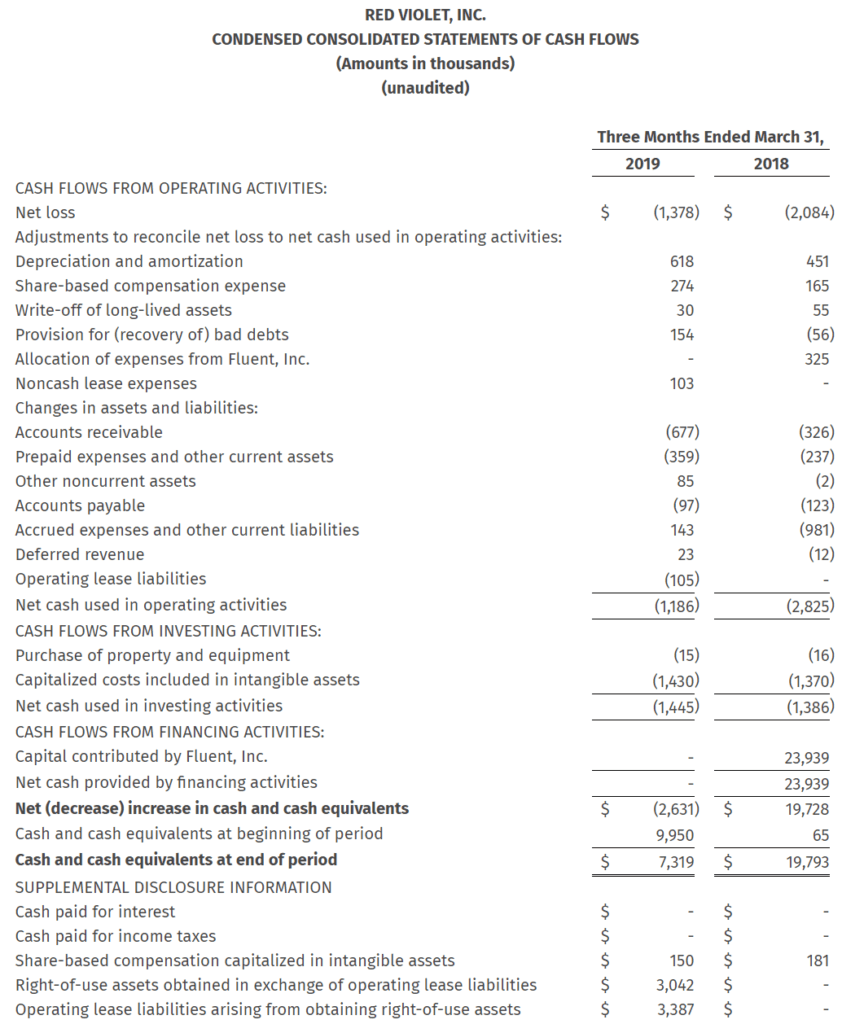

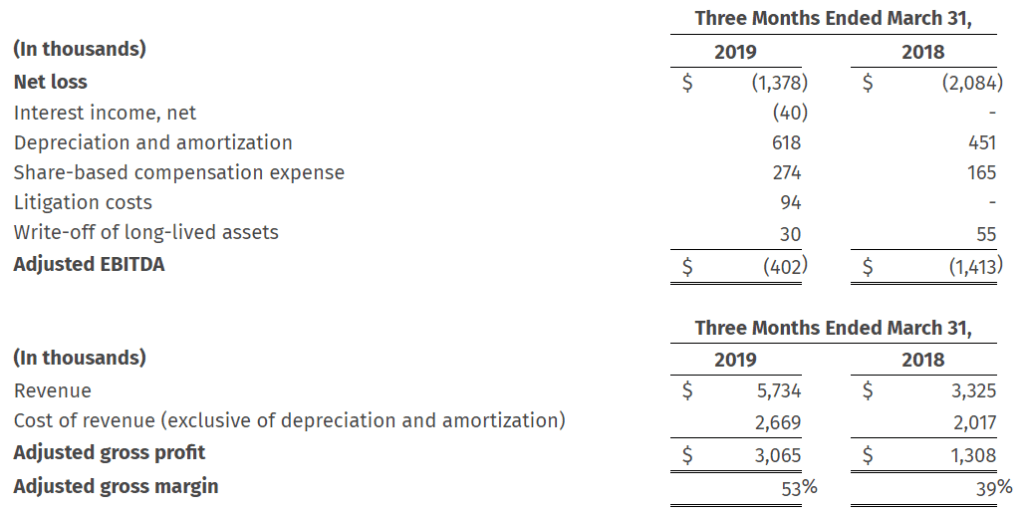

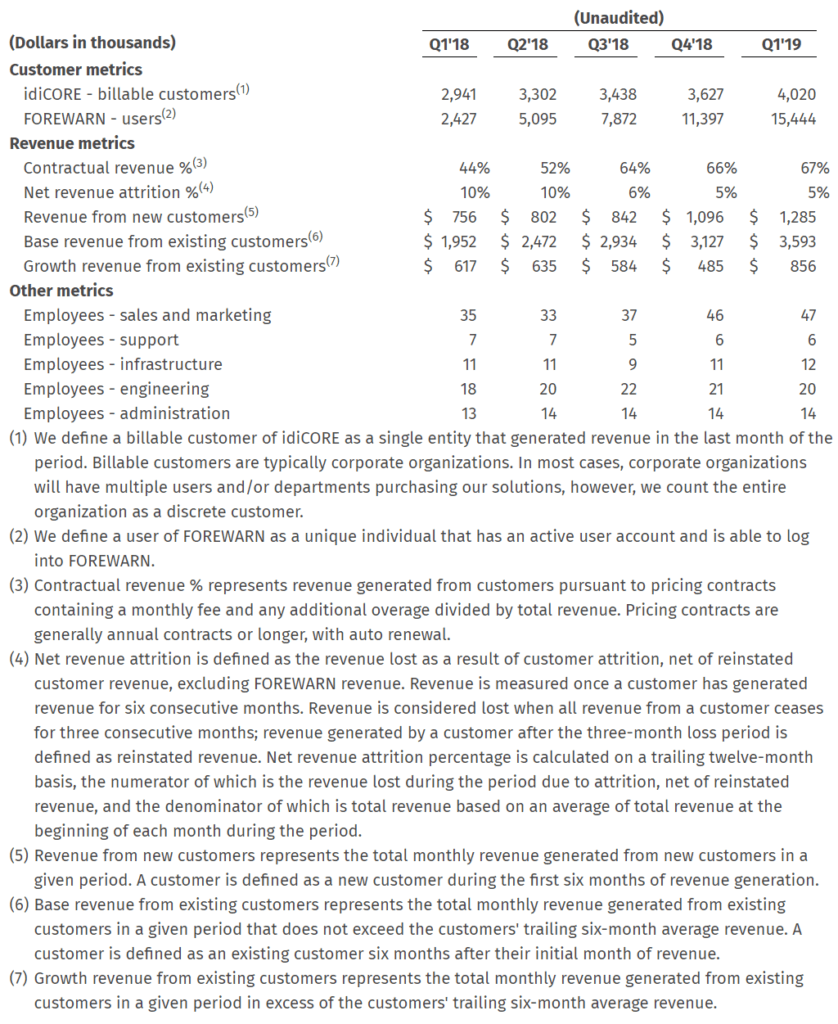

Revenue Increases 72% to $5.7 Million Driving Significant Progress Toward Profitability BOCA RATON, Fla.–(BUSINESS WIRE)–May 7, 2019– Red Violet, Inc. (NASDAQ: RDVT), a leading analytics and information solutions provider, today announced financial results for the quarter ended March 31, 2019 and posted a letter to shareholders on the investor relations section of the Company’s website at https://redviolet.com/shareholderletter. “We started the year off strong and are extremely pleased with our results for the first quarter. With another quarter of sequential record revenue and a significantly improved bottom line, we fully expect 2019 to be a breakout year for red violet,” stated Derek Dubner, red violet’s CEO. “Our team continues to enhance the functionality and performance of our solutions and, as a result, we are winning head-to-head challenges against the competition and driving new use cases for our customers. We added over 390 new idiCORE™ customers in the first quarter and continue to see strong growth in revenue from existing customers.” First Quarter Financial Results For the three months ended March 31, 2019, as compared to the three months ended March 31, 2018: First Quarter and Recent Business Highlights Use of Non-GAAP Financial Measures Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted gross profit and adjusted gross margin. Adjusted EBITDA is a financial measure equal to net loss, the most directly comparable financial measure based on US GAAP, excluding interest income, net, depreciation and amortization, share-based compensation expense, litigation costs, insurance proceeds in relation to settled litigation, transition service income, and write-off of long-lived assets and others, as noted in the tables below. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. About red violet® At red violet, we believe that time is your most valuable asset. Through powerful analytics, we transform data into intelligence, in a fast and efficient manner, so that our clients can spend their time on what matters most – running their organizations with confidence. Through leading-edge, proprietary technology and a massive data repository, our analytics and information solutions harness the power of data fusion, uncovering the relevance of disparate data points and converting them into comprehensive and insightful views of people, businesses, assets and their interrelationships. We empower clients across markets and industries to better execute all aspects of their business, from managing risk, recovering debt, identifying fraud and abuse, and ensuring legislative compliance, to identifying and acquiring customers. At red violet, we are dedicated to making the world a safer place and reducing the cost of doing business. For more information, please visit www.redviolet.com. FORWARD-LOOKING STATEMENTS This press release contains “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as “expects,” “plans,” “projects,” “will,” “may,” “anticipate,” “believes,” “should,” “intends,” “estimates,” and other words of similar meaning. Such forward looking statements are subject to risks and uncertainties that are often difficult to predict, are beyond our control and which may cause results to differ materially from expectations, including whether we expect 2019 to be a breakout year for red violet. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on our expectations as of the date of this press release and speak only as of the date of this press release and are advised to consider the factors listed above together with the additional factors under the heading “Forward-Looking Statements” and “Risk Factors” in red violet’s Form 10-K for the year ended December 31, 2018 filed on March 7, 2019, as may be supplemented or amended by the Company’s other SEC filings. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Use and Reconciliation of Non-GAAP Financial Measures Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted gross profit and adjusted gross margin. Adjusted EBITDA is a financial measure equal to net loss, the most directly comparable financial measure based on US GAAP, excluding interest income, net, depreciation and amortization, share-based compensation expense, litigation costs and write-off of long-lived assets, as noted in the tables below. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. We present adjusted EBITDA, adjusted gross profit and adjusted gross margin as supplemental measures of our operating performance because we believe they provide useful information to our investors as they eliminate the impact of certain items that we do not consider indicative of our cash operations and ongoing operating performance. In addition, we use them as an integral part of our internal reporting to measure the performance of our business, evaluate the performance of our senior management and measure the operating strength of our business. Adjusted EBITDA, adjusted gross profit and adjusted gross margin are measures frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies similar to ours and are indicators of the operational strength of our business. Adjusted EBITDA eliminates the uneven effect of considerable amounts of non-cash depreciation and amortization, share-based compensation expense and the impact of other items. Adjusted gross profit and adjusted gross margin are calculated by using cost of revenue (exclusive of depreciation and amortization). Adjusted EBITDA, adjusted gross profit and adjusted gross margin are not intended to be performance measures that should be regarded as an alternative to, or more meaningful than, either loss before income taxes or net loss as indicators of operating performance or to cash flows from operating activities as a measure of liquidity. The way we measure adjusted EBITDA, adjusted gross profit and adjusted gross margin may not be comparable to similarly titled measures presented by other companies, and may not be identical to corresponding measures used in our various agreements. SUPPLEMENTAL METRICS The following metrics are intended as a supplement to the financial statements found in this release and other information furnished or filed with the SEC. These supplemental metrics are not necessarily derived from any underlying financial statement amounts. We believe these supplemental metrics help investors understand trends within our business and evaluate the performance of such trends quickly and effectively. In the event of discrepancies between amounts in these tables and the Company’s historical disclosures or financial statements, readers should rely on the Company’s filings with the SEC and financial statements in the Company’s most recent earnings release. We intend to periodically review and refine the definition, methodology and appropriateness of each of these supplemental metrics. As a result, metrics are subject to removal and/or changes, and such changes could be material. View source version on businesswire.com: https://www.businesswire.com/news/home/20190507005960/en/ Source: Red Violet, Inc. Investor Relations Contact:

Camilo Ramirez

Red Violet, Inc.

561-757-4500

ir@redviolet.com