RED VIOLET ANNOUNCES THIRD QUARTER 2018 FINANCIAL RESULTS

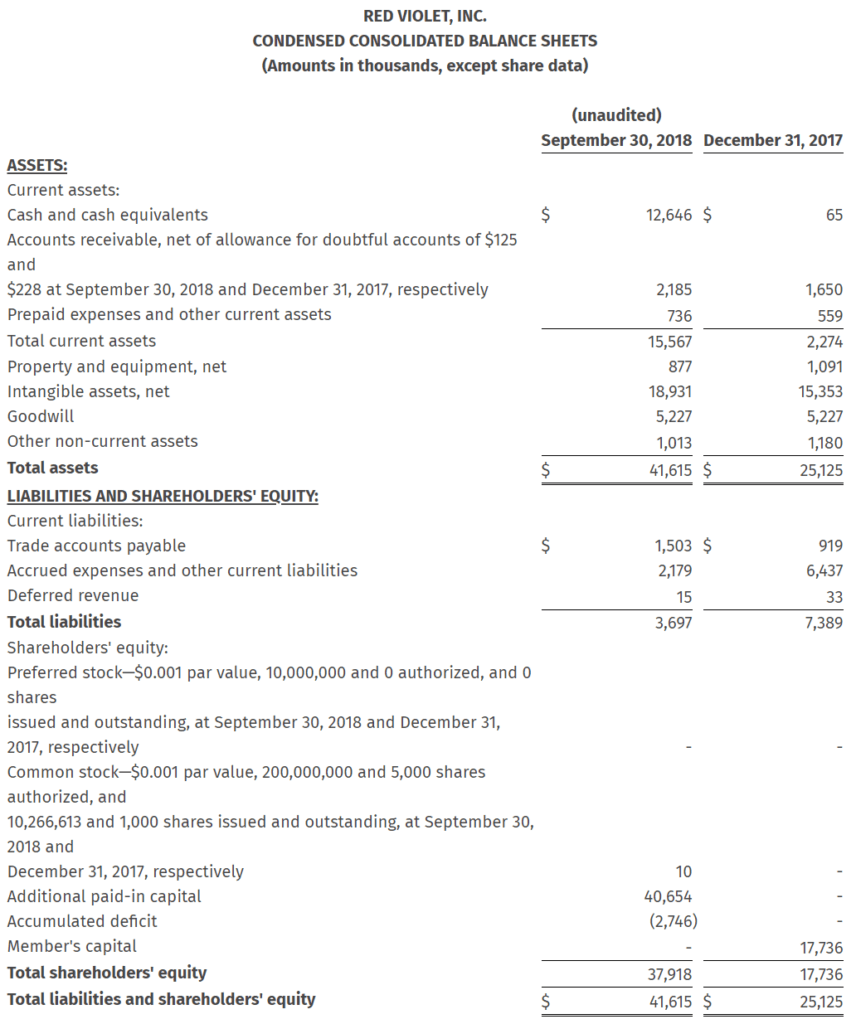

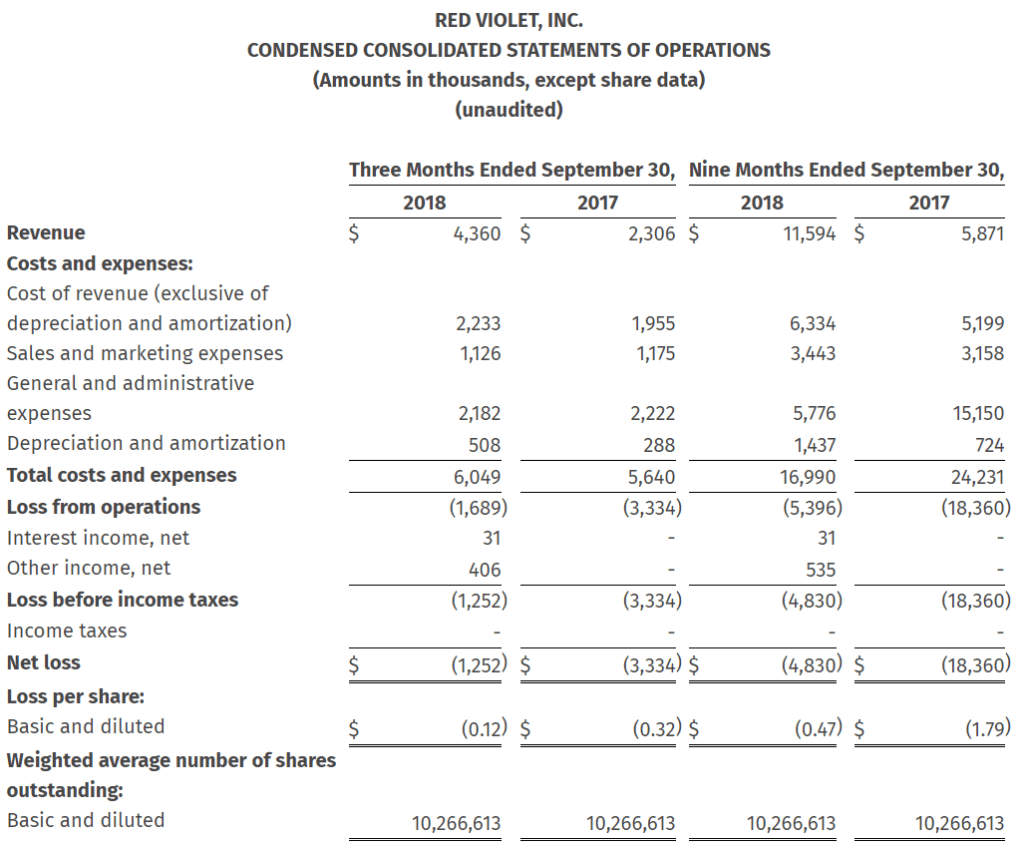

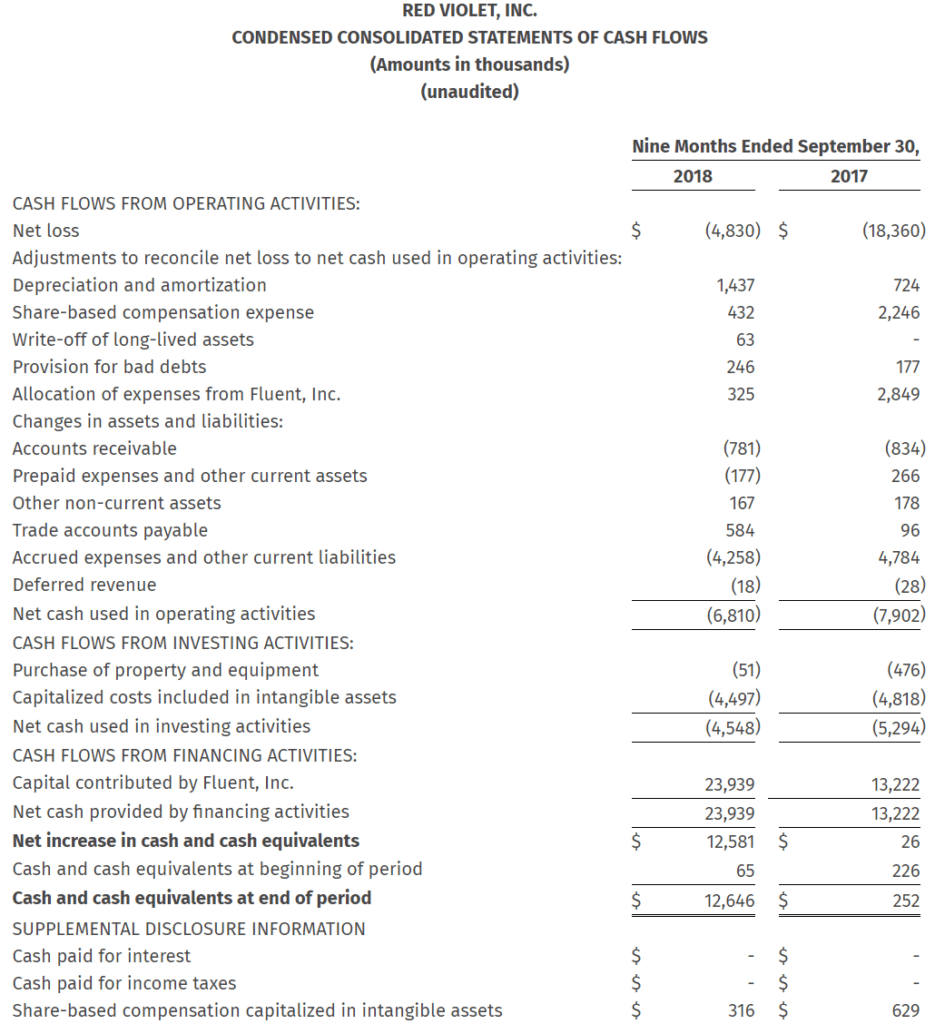

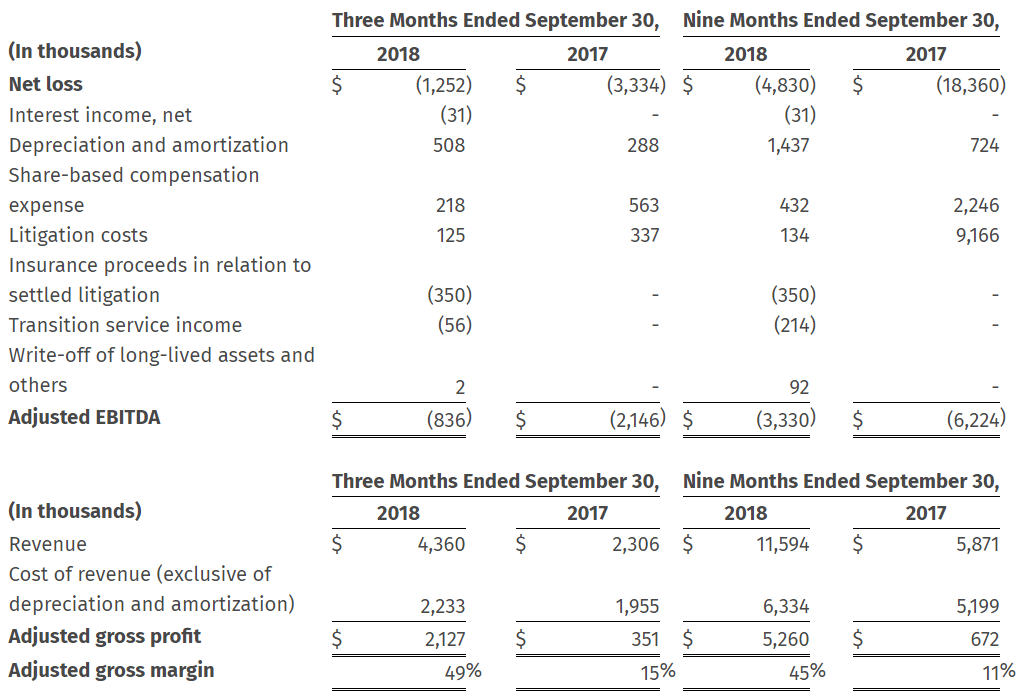

Revenue Increases 89% to $4.4 Million with Continued Margin Expansion and Key Customer Wins Driving Growth and Path to Profitability BOCA RATON, Fla.–(BUSINESS WIRE)–Nov. 7, 2018– Red Violet, Inc. (NASDAQ: RDVT), a leading information solutions provider, today announced financial results for the quarter ended September 30, 2018. “We have delivered another consecutive quarter of solid growth in revenue, adjusted gross margin and adjusted EBITDA in 2018,” stated Derek Dubner, red violet’s CEO. “With a healthy balance sheet, increasing adoption of our solutions at a higher customer tier and across multiple verticals, and a robust product roadmap, we are poised to accelerate our capture of market share. With several key customer wins at the end of the third quarter, which we expect to drive revenue growth with high contribution margin over the next several quarters, we are well positioned for the remainder of 2018 and beyond.” Third Quarter Financial Results For the three months ended September 30, 2018, as compared to the three months ended September 30, 2017: Third Quarter and Recent Business Highlights Adjusted gross profit, adjusted gross margin and adjusted EBITDA are non-GAAP financial measures. Reconciliation of these non-GAAP measures are provided in the attached tables. About red violet® At red violet, we believe that time is your most valuable asset. Through powerful analytics, we transform data into intelligence, in a fast and efficient manner, so that our clients can spend their time on what matters most — running their organizations with confidence. Through leading-edge, proprietary technology and a massive data repository, our data and analytical solutions harness the power of data fusion, uncovering the relevance of disparate data points and converting them into comprehensive and insightful views of people, businesses, assets and their interrelationships. We empower clients across markets and industries to better execute all aspects of their business, from managing risk, conducting investigations, identifying fraud and abuse, and collecting debts. At red violet, we are dedicated to making the world a safer place and reducing the cost of doing business. For more information, please visit www.redviolet.com. FORWARD-LOOKING STATEMENTS This press release contains “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as “expects,” “plans,” “projects,” “will,” “may,” “anticipate,” “believes,” “should,” “intends,” “estimates,” and other words of similar meaning. Such forward looking statements are subject to risks and uncertainties that are often difficult to predict, are beyond our control and which may cause results to differ materially from expectations, including whether we are poised to accelerate our capture of market share, whether the key customer wins at the end of the 2018 third quarter will drive revenue growth with high contribution margin over the next several quarters and whether we are well positioned for the remainder of 2018 and beyond. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on our expectations as of the date of this press release and speak only as of the date of this press release and are advised to consider the factors listed above together with the additional factors under the heading “Forward-Looking Statements” and “Risk Factors” in red violet’s Information Statement filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed with the SEC on March 27, 2018, as may be supplemented or amended by the Company’s Quarterly Reports on Form 10-Q and other SEC filings. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Use and Reconciliation of Non-GAAP Financial Measures Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted gross profit and adjusted gross margin. Adjusted EBITDA is a financial measure equal to net loss, the most directly comparable financial measure based on US GAAP, excluding interest income, depreciation and amortization, share-based compensation expense, litigation costs, insurance proceeds in relation to settled litigation, transition service income, write-off of long-lived assets and others, as noted in the tables below. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. We present adjusted EBITDA, adjusted gross profit and adjusted gross margin as supplemental measures of our operating performance because we believe they provide useful information to our investors as they eliminate the impact of certain items that we do not consider indicative of our cash operations and ongoing operating performance. In addition, we use them as an integral part of our internal reporting to measure the performance of our business, evaluate the performance of our senior management and measure the operating strength of our business. Adjusted EBITDA, adjusted gross profit and adjusted gross margin are measures frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies similar to ours and are indicators of the operational strength of our business. Adjusted EBITDA eliminates the uneven effect of considerable amounts of non-cash depreciation and amortization, share-based compensation expense and the impact of other items. Adjusted gross profit and adjusted gross margin are calculated by using cost of revenue (exclusive of depreciation and amortization). Adjusted EBITDA, adjusted gross profit and adjusted gross margin are not intended to be performance measures that should be regarded as an alternative to, or more meaningful than, either loss before income taxes or net loss as indicators of operating performance or to cash flows from operating activities as a measure of liquidity. The way we measure adjusted EBITDA, adjusted gross profit and adjusted gross margin may not be comparable to similarly titled measures presented by other companies, and may not be identical to corresponding measures used in our various agreements. View source version on businesswire.com: https://www.businesswire.com/news/home/20181107005132/en/ Source: Red Violet, Inc. Red Violet, Inc.

Investors Relations Contact:

Camilo Ramirez, 561-757-4500

ir@redviolet.com