RED VIOLET ANNOUNCES THIRD QUARTER 2019 FINANCIAL RESULTS

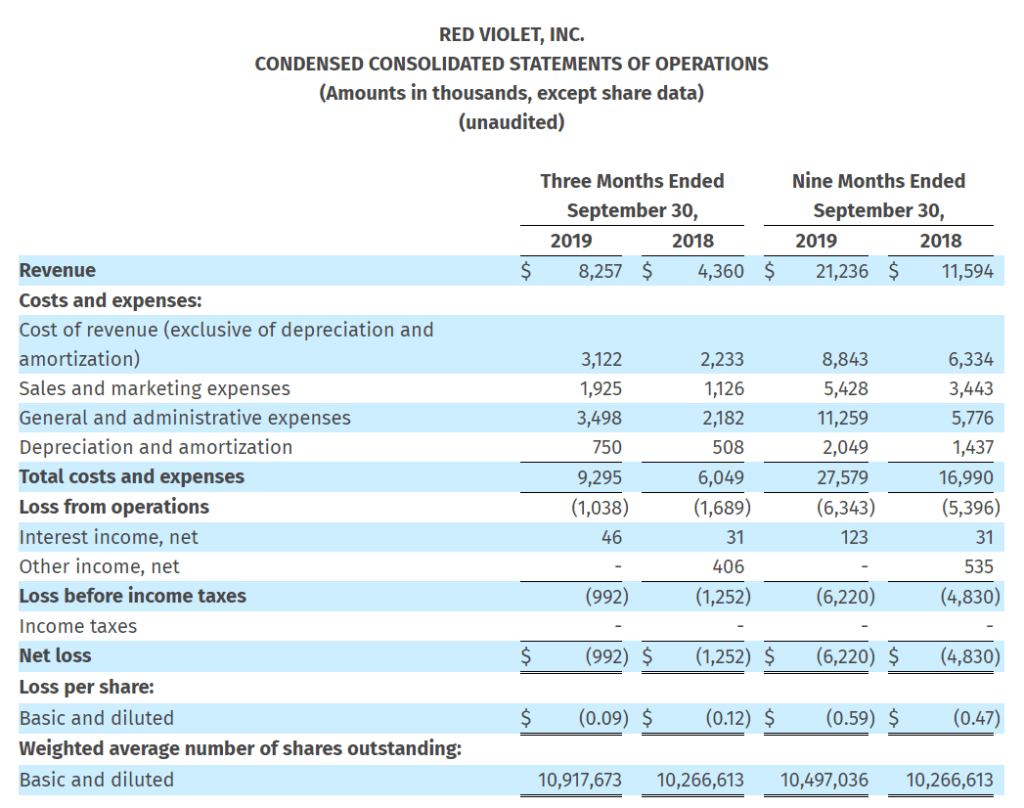

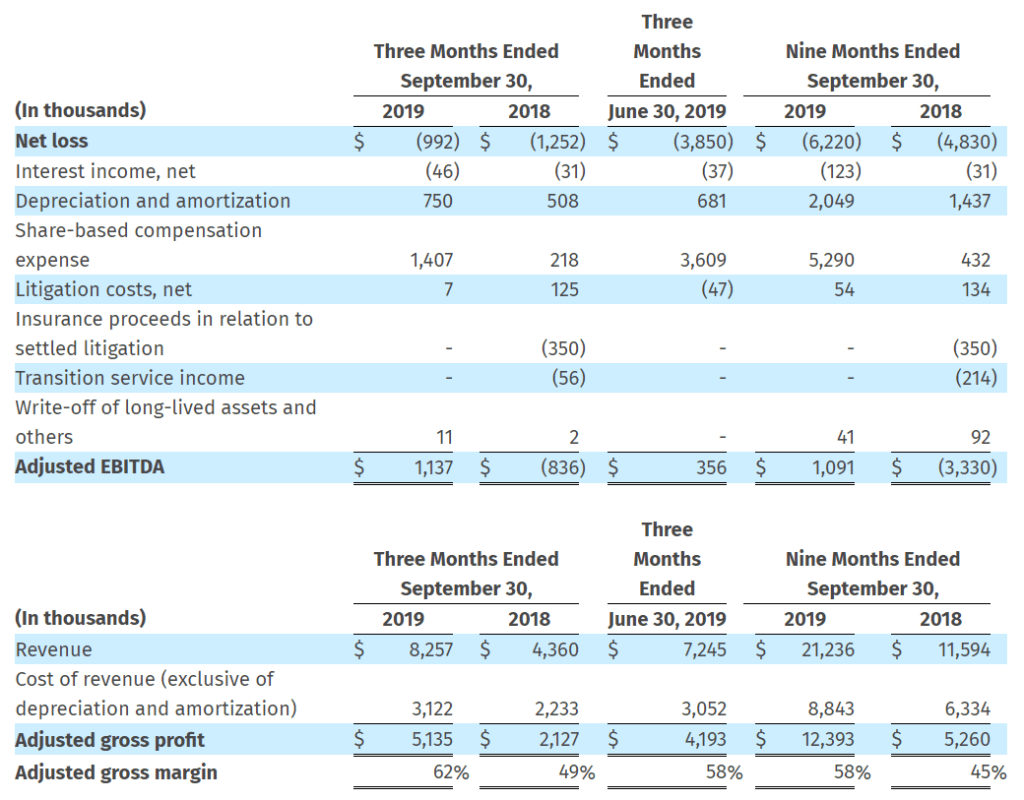

Revenue Increases 89% to $8.3 Million with Strong Margin Expansion and Positive Cash Flow from Operating Activities BOCA RATON, Fla.–(BUSINESS WIRE)–Nov. 7, 2019– Red Violet, Inc. (NASDAQ: RDVT), a leading analytics and information solutions provider, today announced financial results for the quarter ended September 30, 2019. “Since our spin-off in March of 2018, we have reported seven consecutive quarters of record revenue and adjusted gross margin. Adjusted EBITDA increased over 200% from second quarter 2019 and we incurred our smallest quarterly net loss to date,” stated Derek Dubner, red violet’s CEO. “I am very proud of our team’s execution year-to-date, seizing upon immediate opportunities while continuing to lay the groundwork for expected future growth. We are experiencing increasing adoption of idiCORE™ by and among larger customers and FOREWARN® is fastbecoming the go-to solution for proactive realtor safety. While fourth quarter traditionally presents seasonal headwinds affecting our transactional customers in the way of less business days and year-end budget recasting, we have experienced a strong start to the fourth quarter and are excited to close out a terrific 2019.” Third Quarter Financial Results For the three months ended September 30, 2019 as compared to the three months ended September 30, 2018: Third Quarter and Recent Business Highlights Use of Non-GAAP Financial Measures Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted gross profit and adjusted gross margin. Adjusted EBITDA is a financial measure equal to net loss, the most directly comparable financial measure based on US GAAP, excluding interest income, net, depreciation and amortization, share-based compensation expense, litigation costs, net, transition service income, and write-off of long-lived assets and others, as noted in the tables below. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. Conference Call In conjunction with this release, red violet will host a conference call and webcast today a 4:30pm ET to discuss its quarterly results and provide a business update. To listen to the call, please dial (877) 665-6635 for domestic callers or (602) 563-8608 for international callers, using the passcode 1075407. To access the live audio webcast, visit the Investors section of the red violet website at www.redviolet.com. Please login at least 15 minutes prior to the start of the call to ensure adequate time for any downloads that may be required. Following the completion of the conference call, a replay will be available for approximately one week by dialing (855) 859-2056 or (404) 537-3406 with the replay passcode 1075407. An archived webcast of the conference call will be available on the Investors section of the red violet website at www.redviolet.com. About red violet® At red violet, we believe that time is your most valuable asset. Through powerful analytics, we transform data into intelligence, in a fast and efficient manner, so that our clients can spend their time on what matters most – running their organizations with confidence. Through leading-edge, proprietary technology and a massive data repository, our analytics and information solutions harness the power of data fusion, uncovering the relevance of disparate data points and converting them into comprehensive and insightful views of people, businesses, assets and their interrelationships. We empower clients across markets and industries to better execute all aspects of their business, from managing risk, recovering debt, identifying fraud and abuse, and ensuring legislative compliance, to identifying and acquiring customers. At red violet, we are dedicated to making the world a safer place and reducing the cost of doing business. For more information, please visit www.redviolet.com. FORWARD-LOOKING STATEMENTS This press release contains “forward-looking statements,” as that term is defined under the Private Securities Litigation Reform Act of 1995 (PSLRA), which statements may be identified by words such as “expects,” “plans,” “projects,” “will,” “may,” “anticipate,” “believes,” “should,” “intends,” “estimates,” and other words of similar meaning. Such forward looking statements are subject to risks and uncertainties that are often difficult to predict, are beyond our control and which may cause results to differ materially from expectations, including whether red violet will experience future growth, and whether FOREWARN will become the go-to solution for proactive realtor safety. Readers are cautioned not to place undue reliance on these forward-looking statements, which are based on our expectations as of the date of this press release and speak only as of the date of this press release and are advised to consider the factors listed above together with the additional factors under the heading “Forward-Looking Statements” and “Risk Factors” in red violet’s Form 10-K for the year ended December 31, 2018 filed on March 7, 2019, as may be supplemented or amended by the Company’s other SEC filings. We undertake no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events or otherwise, except as required by law. Use and Reconciliation of Non-GAAP Financial Measures Management evaluates the financial performance of our business on a variety of key indicators, including non-GAAP metrics of adjusted EBITDA, adjusted gross profit and adjusted gross margin. Adjusted EBITDA is a financial measure equal to net loss, the most directly comparable financial measure based on US GAAP, excluding interest income, net, depreciation and amortization, share-based compensation expense, litigation costs, net, transition service income, and write-off of long-lived assets and others, as noted in the tables below. We define adjusted gross profit as revenue less cost of revenue (exclusive of depreciation and amortization), and adjusted gross margin as adjusted gross profit as a percentage of revenue. We present adjusted EBITDA, adjusted gross profit and adjusted gross margin as supplemental measures of our operating performance because we believe they provide useful information to our investors as they eliminate the impact of certain items that we do not consider indicative of our cash operations and ongoing operating performance. In addition, we use them as an integral part of our internal reporting to measure the performance of our business, evaluate the performance of our senior management and measure the operating strength of our business. Adjusted EBITDA, adjusted gross profit and adjusted gross margin are measures frequently used by securities analysts, investors and other interested parties in their evaluation of the operating performance of companies similar to ours and are indicators of the operational strength of our business. Adjusted EBITDA eliminates the uneven effect of considerable amounts of non-cash depreciation and amortization, share-based compensation expense and the impact of other items. Adjusted gross profit and adjusted gross margin are calculated by using cost of revenue (exclusive of depreciation and amortization). Adjusted EBITDA, adjusted gross profit and adjusted gross margin are not intended to be performance measures that should be regarded as an alternative to, or more meaningful than, either loss before income taxes or net loss as indicators of operating performance or to cash flows from operating activities as a measure of liquidity. The way we measure adjusted EBITDA, adjusted gross profit and adjusted gross margin may not be comparable to similarly titled measures presented by other companies, and may not be identical to corresponding measures used in our various agreements. The following metrics are intended as a supplement to the financial statements found in this release and other information furnished or filed with the SEC. These supplemental metrics are not necessarily derived from any underlying financial statement amounts. We believe these supplemental metrics help investors understand trends within our business and evaluate the performance of such trends quickly and effectively. In the event of discrepancies between amounts in these tables and the Company’s historical disclosures or financial statements, readers should rely on the Company’s filings with the SEC and financial statements in the Company’s most recent earnings release. We intend to periodically review and refine the definition, methodology and appropriateness of each of these supplemental metrics. As a result, metrics are subject to removal and/or changes, and such changes could be material. View source version on businesswire.com: Source: Red Violet Investor Relations Contact:

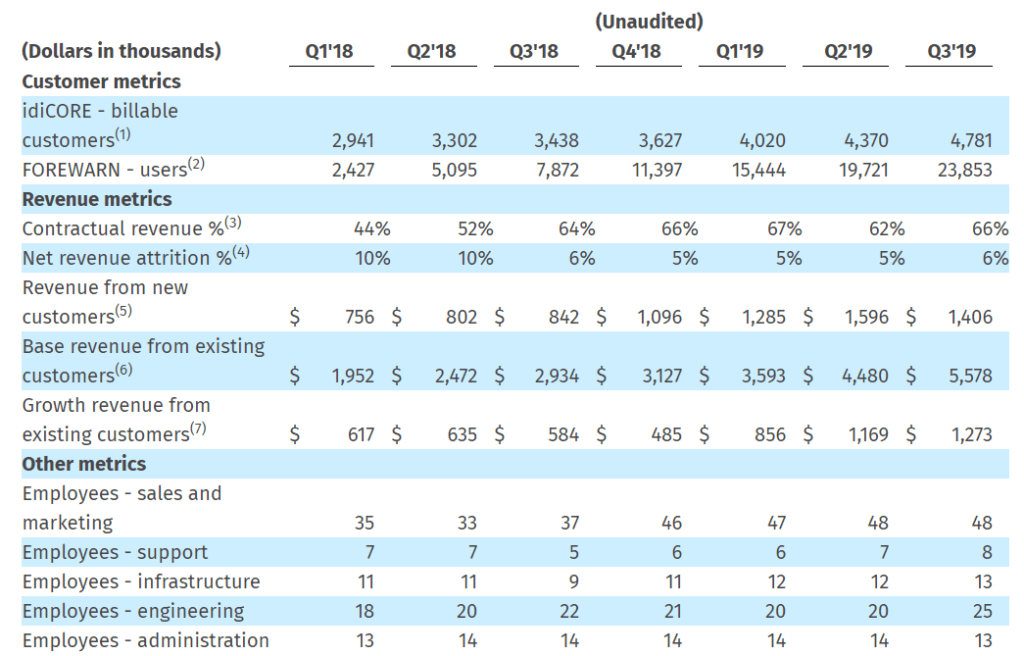

SUPPLEMENTAL METRICS

(1) We define a billable customer of idiCORE as a single entity that generated revenue in the last month of the period. Billable customers are typically corporate organizations. In most cases, corporate organizations will have multiple users and/or departments purchasing our solutions, however, we count the entire organization as a discrete customer. (2) We define a user of FOREWARN as a unique individual that has an active user account and is able to log into FOREWARN. (3) Contractual revenue % represents revenue generated from customers pursuant to pricing contracts containing a monthly fee and any additional overage divided by total revenue. Pricing contracts are generally annual contracts or longer, with auto renewal. (4) Net revenue attrition is defined as the revenue lost as a result of customer attrition, net of reinstated customer revenue, excluding FOREWARN revenue. Revenue is measured once a customer has generated revenue for six consecutive months. Revenue is considered lost when all revenue from a customer ceases for three consecutive months; revenue generated by a customer after the three-month loss period is defined as reinstated revenue. Net revenue attrition percentage is calculated on a trailing twelve-month basis, the numerator of which is the revenue lost during the period due to attrition, net of reinstated revenue, and the denominator of which is total revenue based on an average of total revenue at the beginning of each month during the period. (5) Revenue from new customers represents the total monthly revenue generated from new customers in a given period. A customer is defined as a new customer during the first six months of revenue generation. (6) Base revenue from existing customers represents the total monthly revenue generated from existing customers in a given period that does not exceed the customers’ trailing six-month average revenue. A customer is defined as an existing customer six months after their initial month of revenue. (7) Growth revenue from existing customers represents the total monthly revenue generated from existing customers in a given period in excess of the customers’ trailing six-month average revenue.

Camilo Ramirez

Red Violet, Inc.

561-757-4500

ir@redviolet.com